Your student loan payments are due: 3 strategies to support community college students’ financial wellness

September 26, 2023, By Whitney Wilson, Strategic Leader, Student Success Allison Peeler, LMSW, Senior Analyst

When I think back to my time in college, student loans were something that nearly everyone had, but not something any of us fully understood. Specifically, we weren’t educated on how to repay them. They were a necessary evil to be addressed “later.” With loan repayments officially resuming in October 2023, the “later” problem cannot be put off any longer.

While loan payments will continue to be stalled for students actively enrolled at your institution, there are a number of ways they could negatively impact your students—and your retention rates—today. Fortunately, there are ways community colleges can proactively assist students facing financial hardships and help them stay on the path to timely (and affordable) completion.

This blog post will explore the chief concerns of community college students and recent graduates regarding loan repayment, and three strategies to better support them.

The impact of student loan repayment on current community college students

Though loan repayment is paused for your current students, it may not be paused for other members of their household. Nationwide, students are facing different financial challenges now than they were three years ago. With more than two-thirds of community college students requesting aid annually, 30% being Pell-eligible, 16% being single parents—and inflation at a perilous high—everyone is feeling the effects of one more line-item in the household budget each month.

These concerns could impact retention as current students think critically about taking on more debt. It could also affect recruitment as prospective students are more likely to question whether college is worth the cost in the first place.

-

20%

of high school students reported college isn’t “worth the cost” in 2023, up from 8% in 2019. (Source: EAB Student Communication Preferences Survey 2023)

Financial concerns are highly correlated to both stopping out and mental health challenges. Financial hardship is the #1 reason students stop out. And more financially vulnerable student borrowers, such as Black students, are going to feel this struggle even more acutely long before repayment begins. According to a White House report, “the typical Black borrower who started college in the 1995-96 school year still owed 95% of their original student debt” 20 years after college, and many still do not have a degree.

These challenges compound anxiety among student borrowers early on, and according to the Education Trust, 64% of Black students surveyed reported student debt negatively impacted their mental health. But the problem is even bleaker than that: a survey by Student Loan Planner found 1 in 14 high-debt borrowers (not race-specific) experienced suicidal ideation due to student loan debt.

-

1 in 14

high-debt borrowers experienced suicidal ideation due to student loan debt. (Source: Student Loan Planner Mental Health Survey 2021)

Three strategies to enhance student financial wellness and prepare students for loan repayment

1. Proactively inform students nearing graduation about what to expect, as well as available on-campus resources as they navigate loan repayment plans

For some students, federal student loan payments may have been paused for the entirety of their higher education career thus far. Understanding repayment options, especially in light of the new changes, can be overwhelming. Institutions should consider proactively sharing information and resources related to student loan repayment with soon-to-be-graduating students.

Financial aid offices are well-positioned to provide guidance on these areas, but there are likely other offices on campus who also have resources to support students as they make this financial transition such as money management centers or student services. Consider consolidating a list of campus supports available to students and sharing it out in easy-to-access locations across campus, on your website, and in your student mobile app. Make sure to keep the materials up to date so students know about timely and accurate resources, and how to access them.

Messaging campaigns and to-dos within EAB’s Navigate360 CRM are great tools to help send targeted messaging and nudges to students about financial wellness resources*.

2. Re-evaluate your stop-out and student success strategies to include financial wellness from the start

As institutions continue to fight enrollment declines, many are looking to reenroll stop-outs. As mentioned previously, finances are the leading reason students stop out of college. While students may stop out at any point, they often return to campus with much more complex lives than when they left and have competing demands for their time.

To help your current students avoid stopping out due to financial challenges and make it easier to support students when they return, colleges should proactively and intentionally integrate student financial wellness into their stop-out and student success strategies. Stopping out may also mean a student unexpectedly needs to begin loan repayment well before they complete their credential. This can be a stressful adjustment, but if you’ve provided students with financial tools early in their journey, they’ll be in a better place to manage those challenges if they occur.

Support your students from day one by making financial literacy a mandatory part of your orientation process. You can leverage ready-made, reputable programs available such as Hands On Banking and FDIC’s Money Smart, create your own, or partner with a local community organization who provides this service. Make sure to cover topics such as choosing the right types of loans and repayment plans, applying for scholarships, budgeting, and even how to file your taxes. Include a list of resources for students to access if finances become a barrier during their academic journey. Remind them about available resources often, and at the top of each semester. You can also expand access and support by offering self-guided refresher courses across the academic year.

Finally, consider ways to reduce the amount of loans students need in general, with expanded options like work study and real-cost calculators. These practical and transparency-building strategies will help current and returning students feel more secure in their decision to pursue and complete their credential at your college.

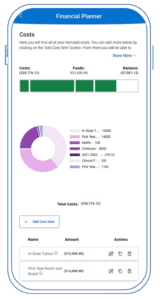

Navigate360 Student, EAB Navigate360’s student mobile app, empowers students to understand the real costs of education and make informed decisions.

Below is a list of items that institutions should include in their financial wellness support offerings based on EAB analysis. As you review these resources, consider these questions: What does your institution do well? Where is there room for improvement?

- Public Benefits: Students can learn about and access public benefits on campus.

- Staff Resource Guides: Staff receives lists of local resources to support students in financial crisis.

- Campus Liaison: The college has a designated liaison for students facing a financial emergency.

- Financial Literacy: Virtual and in-person training is provided to students.

- Financial Aid Promotion: Marketing materials clearly explain financial aid eligibility and options.

- FAFSA Guidance: Students receive support when completing FAFSA and throughout the verification process.

- Financial Aid Nudges: Students who don’t take action on verification are contacted by staff to explain next steps

- Returning Student Incentives: Information about fiscal incentives for returning students are visible on the college website and/or sent to appropriate students.

- Microgrants: Funds are available and promoted to appropriate students to prevent small debts from hindering future enrollment. (Explore how one college retained more students and closed equity gaps with retention micro-grants and registration hold reform.)

How well does your institution support returning stop-outs? Take the diagnostic to find out.

3. Use technology to enhance financial wellness

Today’s students expect you to provide fast, accurate, tech-forward customer service to help them succeed and balance their academic demands with personal ones. There are several ways institutions can leverage technology to enhance the way they foster student financial wellness and help them overcome bumps in the road:

Use data to identify students who urgently need support

Ensure your campus data systems are integrated so you can track and proactively connect with students who may be at highest risk for financial challenges. Use a population health management approach to monitor trends among student populations who may be disproportionately affected by financial insecurity and get ahead of stop-out risks before it is too late.

This also enables your staff to prioritize outreach efforts and work more efficiently to reduce disparities and foster equitable access to education and financial stability.

Quick polls: A proactive, low-lift connection to mitigate. financial challenges

Leverage communication tools such as quick polls to proactively engage with students about their financial challenges. These short and user-friendly surveys can be conducted at scale through tools such as Navigate360.

By gathering real-time insights into students’ financial concerns, leaders can tailor their support strategies effectively. For instance, a poll might inquire about the specific aspects of loan repayment causing anxiety or if students are aware of available resources. The information gleaned from these polls enables leadership to develop targeted solutions that directly address students’ needs.

Campaigns and to-dos

Use automated email campaigns, social media, and your student app to regularly reach out to students with valuable financial wellness tips and resources. These campaigns can cover a range of topics, from budgeting and managing debt to the importance of building good credit. By delivering personalized and timely information directly to students’ digital devices, colleges ensure that financial advice is readily accessible and not lost in the noise of daily life.

Implementing digital to-do lists within student portals or mobile apps can help students stay organized and on top of their financial responsibilities. These to-do lists can include reminders for completing the Free Application for Federal Student Aid (FAFSA), deadlines for scholarship applications, and tasks related to loan repayment, such as signing up for income-driven repayment plans. By breaking down financial tasks into manageable steps and providing automated reminders, colleges empower students to take charge of their financial wellness.

Partner spotlight: Yakima Valley College used Navigate360 to deploy a strategic messaging campaign to students who were dropped for non-payment in summer 2023. The campaign offered students specific next steps on how to re-enroll and manage financial needs to support their continued enrollment. Within a few days, they had successfully reenrolled over 100 students—more than half of the students who received the campaign.

Self-guidance and self-directed resources

Encourage self-guidance with a comprehensive mobile app such as Navigate360 Student that connects students to appropriate resources, timely information, FAQs, and on-demand guidance. Make sure students can easily discover and contact their care network as soon as a challenge arises.

You can also enable a new feature called Hand Raise in Navigate360 Student that allows students to signal for assistance on customizable alert topics. Based on your campus’ resources, you can set alerts on topics such as tutoring, well-being, basic needs, or financial insecurity, and empower students to request help early. Establish alert workflows that trigger the right team to triage and respond to student needs quickly.

Ensure faculty are part of the feedback loop

Faculty are often the first to spot troubling signs in a student’s momentum, such as increased anxiety, financial challenges, or missed classes. Ensure your campus leverages a system that enables faculty to issue alerts to the right student service offices as soon as a problem arises. Decrease barriers between faculty and staff with a streamlined, tech-first approach that makes it easy for faculty to play an active role in students’ success beyond their academic needs.

Read our blog for tips on building faculty buy-in for student success initiatives

Choose an ecosystem that brings all these strategies together

EAB’s Navigate360 CRM empowers staff, advisors, students, and faculty to easily connect and work together to achieve success. Navigate360’s powerful recruitment and retention tools, communications platform, and analytics span the entire student lifecycle, streamlining workflows for staff and providing a better experience for students. Navigate360 partners see a 3.5% increase in graduation rates on average.

By empowering students with financial wellness tools early and across their academic journey, your institution can help foster a sense of financial responsibility and preparedness among students, ensuring they are better equipped to handle the challenges of student loan repayment and financial independence.

Ready to find out more?

Fill out the form and someone from our team will get back to you with more information.

More Blogs

Fall 2020 enrollment: The truth behind early trends in the community college and graduate certificate markets

3 lessons from fall 2020 and what they mean for future community college enrollments